Business

Kenyan Business – Embark on an insightful journey into the ever-evolving world of global business with TrendBlend’s Business Category. As Kenya’s premier Media House, TrendBlend not only offers real-time updates and comprehensive analyses but also serves as an unparalleled advertising platform for businesses.

Transitioning seamlessly from groundbreaking innovations to corporate strategies, TrendBlend ensures that you stay well-informed in the dynamic realm of business. Whether you’re an entrepreneur, investor, or industry enthusiast, TrendBlend’s Business Category provides the knowledge needed to adeptly navigate the complexities of the global business arena.

In a media landscape where staying ahead is paramount, TrendBlend emerges as a beacon of accurate and timely business information. With our finger on the pulse of global business trends, we empower our audience to make informed decisions, fostering success in their endeavors.

The Business Category at TrendBlend stands as a testament to our commitment to delivering high-quality content that matters. From market trends to technological breakthroughs, we curate content that resonates with businesses of all scales. Our dedication to accuracy and relevance ensures that each piece of information adds significant value to our audience.

In the fast-paced world of business, staying informed is not just an advantage; it’s a necessity. TrendBlend’s Business Category acts as your strategic partner, offering insights that go beyond the surface. We delve into the intricacies of various industries, providing in-depth analyses that uncover opportunities and threats.

Additionally, Trust TrendBlend to be your ally in exploring the future of business and advertising. Our platform serves as a catalyst for businesses to amplify their visibility, making us the unrivaled choice for staying connected with the pulse of the business world in Kenya and beyond. Embrace the power of information with TrendBlend’s Business Category – where every update propels you toward success. Business in kenya

Importing Goods from China After the Lunar New Year

Sourcing products from China allows businesses to meet current market demands and stay ahead of trends.

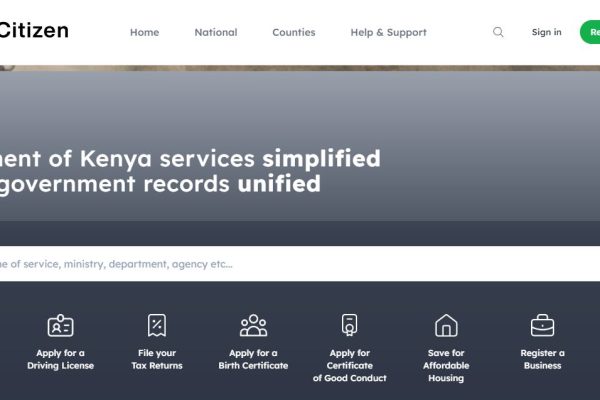

E-Citizen Platform Pioneers Government Digital Transformation

In a groundbreaking move towards a digitally empowered Kenya, the Government has taken a significant step by introducing the E-Citizen platform. James Ayugi, the visionary behind this transformative initiative, has confirmed that the platform is not only 100% owned by the government but also licensed by them. While the government retains ownership, Ayugi’s team has played a pivotal role by contributing the cutting-edge technology that powers this revolutionary system. E-Citizen emerges as a comprehensive solution designed to streamline and modernize the way Kenyan citizens interact with various government services. With a commitment to transparency, efficiency, and accessibility, the platform serves as a one-stop-shop for an array of services, including tax payments, accessing government services, and even facilitating school payments. Ayugi’s affirmation of the government’s ownership of E-Citizen underscores the administration’s dedication to harnessing technology for the greater good of the nation. The platform represents a pivotal moment in Kenya’s journey towards a more digitally inclusive and efficient governance structure. The overarching goal of E-Citizen is to centralize government financial transactions, making it easier for citizens to fulfill their civic duties and access essential services. The platform not only aims to streamline tax payments but also seeks to extend its reach to encompass a wide array of government services. This includes everything from license renewals to permit applications, providing citizens with a convenient and efficient way to interact with their government. Furthermore, E-Citizen is set to revolutionize school payments, simplifying processes for parents and educational institutions alike. The platform’s integration into the education sector showcases its versatility and potential to positively impact various facets of Kenyan society. As Kenya positions itself as a digital leader on the African continent, E-Citizen stands as a testament to the government’s commitment to innovation. By consolidating financial transactions and government services into a single, user-friendly platform, the administration aims to create a more transparent, accountable, and accessible governance structure. In conclusion, E-Citizen represents a landmark initiative in Kenya’s journey towards a digitally transformed and citizen-centric government. With James Ayugi’s technological expertise complementing the government’s ownership, the platform has the potential to redefine the way Kenyan citizens engage with their government and access essential services. As the nation embraces this digital era, E-Citizen stands out as a beacon of progress and a testament to Kenya’s commitment to a more efficient and inclusive future.

Navigating the Impact: Understanding the Effects of a Weakening Kenyan Shilling to the US Dollar on Business

The foreign exchange market is a dynamic landscape that significantly influences global trade and economic stability. For Kenya, whose currency, the Kenyan Shilling (Ksh), occasionally faces fluctuations against major currencies like the US Dollar, understanding the implications of a weakened Ksh is crucial for businesses and stakeholders. In this article, we will delve into the effects of a depreciating Ksh against the US Dollar and how businesses can navigate these challenges. Import Costs and Inflation:One of the immediate consequences of a weakened Ksh is the increased cost of importing goods and services. As Kenya relies on imports for various products, from raw materials to finished goods, a depreciating currency results in higher prices for these imports. This, in turn, contributes to inflationary pressures, impacting the cost of living for consumers and posing challenges for businesses in managing their operational expenses. Export Opportunities:While a weaker currency may present challenges for import-dependent businesses, it can offer opportunities for exporters. Kenyan goods and services become more competitively priced in the international market, potentially boosting export volumes. Businesses with a focus on foreign markets may find increased demand for their products as a result of a favorable exchange rate, thereby balancing the impact of a weakened Ksh. Foreign Debt Burden:For businesses that have borrowed in foreign currencies, a depreciating Ksh can result in an increased burden of servicing foreign debt. Repayments become more expensive in local currency terms, affecting the financial health of companies that have significant liabilities denominated in US Dollars or other foreign currencies. Prudent financial management and hedging strategies become essential for mitigating the risks associated with foreign debt during periods of currency depreciation. Tourism and Hospitality Industry:Kenya’s vibrant tourism and hospitality industry is particularly sensitive to exchange rate fluctuations. A weakened Ksh may make the country a more attractive destination for foreign tourists, as their currencies go further. Conversely, businesses within the industry that rely on importing goods or services may face increased costs. Striking a balance and adapting pricing strategies accordingly becomes crucial for the sustainability of businesses in this sector. Investor Confidence and Capital Flows:A depreciating currency can impact investor confidence in the Kenyan market. Foreign investors may become cautious, fearing potential losses due to currency fluctuations. This could result in capital outflows, putting pressure on the local financial markets and affecting overall economic stability. Maintaining a transparent and stable economic environment, along with sound fiscal policies, becomes imperative for retaining and attracting foreign investment. Conclusion:In conclusion, the effects of a weakening Kenyan Shilling against the US Dollar are multifaceted and touch various aspects of the economy. While import-dependent businesses may face challenges related to increased costs and inflation, exporters and the tourism industry stand to benefit from enhanced competitiveness and increased foreign spending. Businesses navigating this environment must adopt strategic measures, including effective risk management, prudent financial planning, and adaptation of pricing strategies. Moreover, government authorities play a pivotal role in maintaining economic stability through transparent policies and initiatives that instill confidence in the local and international business communities. As Kenya continues to evolve in the global economic landscape, a comprehensive understanding of the impacts of currency fluctuations is essential for businesses to thrive in an interconnected world.